PropNex Picks

|December 06,2024My Lease is Decaying! What Should I Do?

Share this article:

Leasehold properties are like avocados. You leave it alone for days thinking it's not quite ready yet, but then all of a sudden it's an overripe mush. That's lease decay for you. As your lease term shortens, the property's value starts to decline. But this isn't just about watching the numbers drop. It's about understanding how this process affects your financial future, your options for selling, and your ability to secure financing. So what can you do to navigate lease decay and how can you protect your investment and peace of mind?

As I've mentioned, lease decay refers to the reduction in property value as the remaining lease term shortens. This is particularly prevalent in Singapore, where many residential properties are leasehold (typically 99 years). Once the lease is up, the property is returned to the state, regardless of whether it's public or private.

As Singapore is a relatively young nation, we haven't actually seen the end of a 99-year lease. But at the end 2020, 191 units in Geylang Lorong 3 were returned to the state with no compensation or extension after reaching the end of its 60-year lease. This indicates that the same will happen to 99-year leasehold properties.

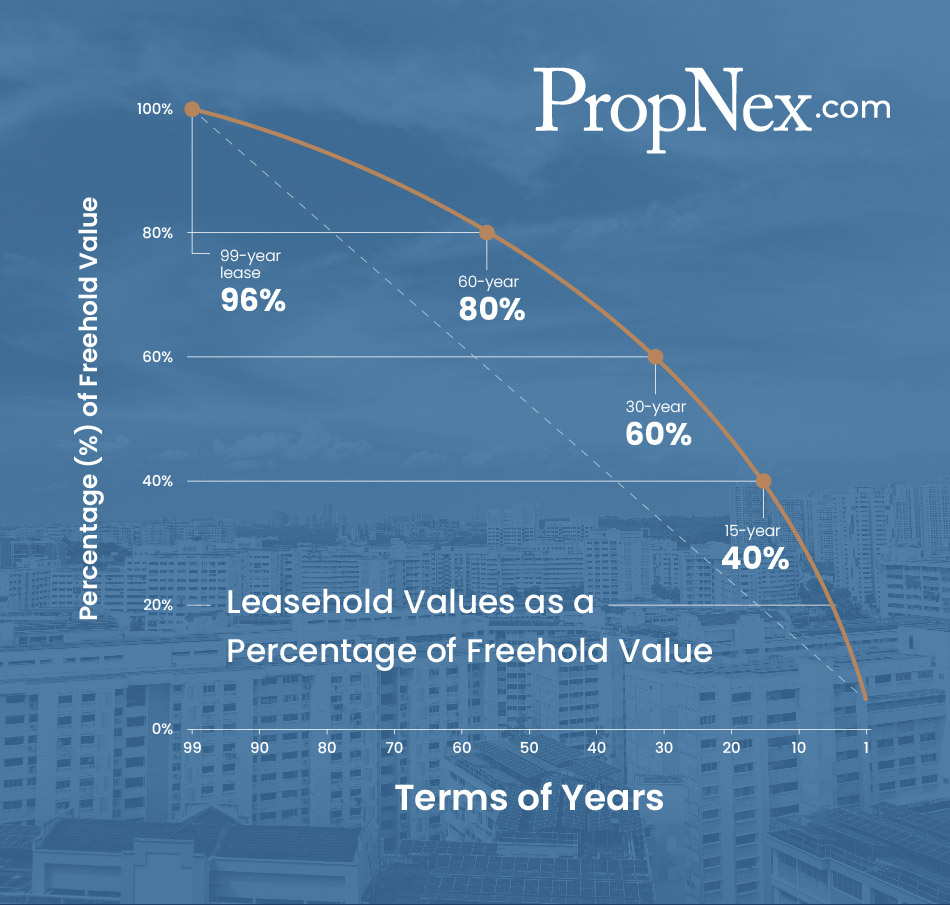

Still think your leasehold property is safe? Think again. Below is the bala's curve, a graph illustrating the unavoidable fall of your property value. As your property ages, the perceived future rental income becomes less valuable causing the decline. But in reality, leasehold property values can stay relatively steady in the early years and keep pace with inflation. It's not until around the 40-year mark that the effect of the bala's curve inevitably catches up as we have seen in mature estates like Toa Payoh and Clementi. However, not all properties suffer equally. Some, like Neptune Court and Mandarin Gardens, have managed to defy the odds. That's why it's important to study the market and understand the factors that can help a property stand strong against lease decay.

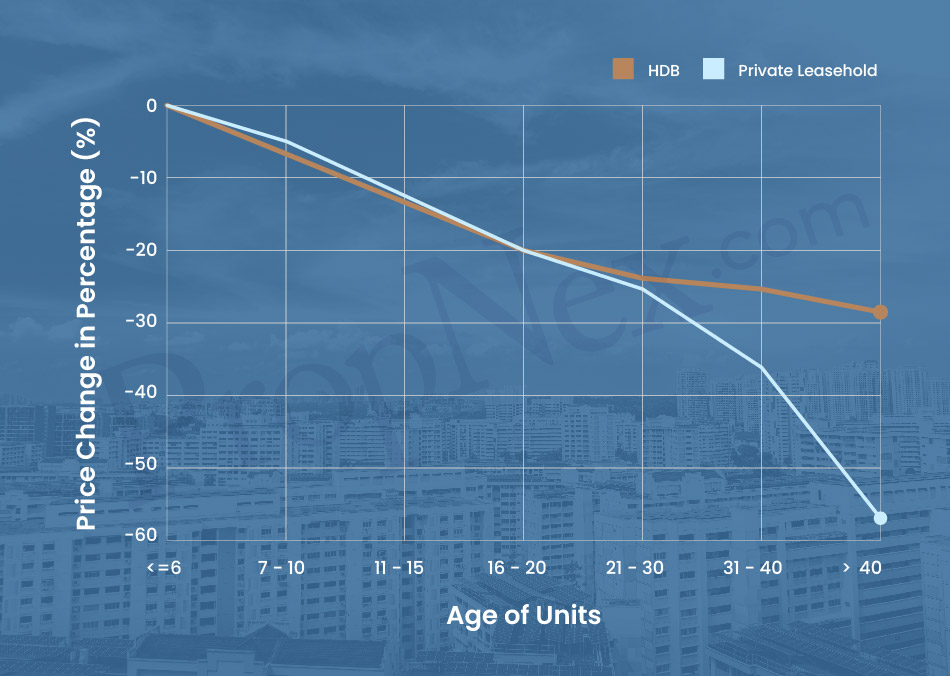

Here's a shocking stat for you: the resale transaction price of private leasehold properties depreciates by over 30% after the 20-year mark, whereas HDB flats only drop by 3%.

A plausible explanation for this is because private properties don't have the same government-backed solutions that some HDB flats may eventually receive (more on this later). Then, there are buyers who view private properties as an investment asset rather than a long-term home. They expect both rental income and capital appreciation. As the lease decays, these expectations aren't being met and selling at a good price becomes more challenging. This depreciation effect is less pronounced for HDB flats because they are primarily meant for owner-occupancy rather than investment.

As mentioned, lease decay leads to value depreciation and rental demand. Not everyone wants to stay at an old unit because people typically prefer modern amenities and facilities. Those who do probably do it for affordability reasons, meaning you may need to lower rental prices to stay competitive, ultimately reducing your rental income. What's even more concerning is how much harder it is to sell. You attract fewer buyers as most avoid units with lease decay, especially as the property nears its 40th year.

On top of that, you may face financing limitations. For instance, banks may reduce the maximum loan amount for older units. Furthermore, CPF funds cannot be used to purchase properties with 20 or fewer years remaining on the lease. Fortunately, these restrictions may never affect your property because it might not even reach that point. However, they highlight the potential limitation for buyers considering ageing leasehold properties. Regardless, it is a factor to keep in mind for long-term investments.

If you own a private property, you can opt to pay a lease top-up to the Singapore Land Authority (SLA) to extend the lease back to 99 years. However, approval for the lease extension is not guaranteed and is at the SLA's discretion. The top-up amount is also determined by the SLA's Chief Valuer and it can be quite costly, reaching millions of dollars. So this isn't exactly everyone's first choice, unless the property's sentimental value or rental income can justify the hefty cost.

The good news is that your property may never reach the end of its lease if it gets chosen for an en bloc, which is a collective sale of an entire development. For private properties, this can happen if 80-90% of the residents agree to sell their units simultaneously to a single buyer, usually a property developer. This would be the most beneficial for owners because en bloc sales often result in significantly higher payouts.

The HDB equivalent of that is the Selective En Bloc Redevelopment Scheme (SERS), a programme that serves to renew older HDB housing estates. Under this scheme, HDB acquires decades-old properties that might require significant upgrading or even complete reconstruction. Residents are then offered fair compensation, relocation options and other rehousing benefits.

Sounds too good to be true right? Well that's because it is. Since its launching in 1995, only 4 percent of HDB flats have been marked for SERS, and it's almost always leasehold properties in really good locations. Meanwhile, flats that the government deems unsuitable for renewal will likely be allowed to reach the end of their leases without extension or redevelopment. So before you join the trend of buying resale flats in hopes that they eventually get marked for SERS, you might want to reconsider your options.

HDB also has the Voluntary Early Redevelopment Scheme (VERS), which is actually quite similar to SERS, but less generous in compensation. The main difference is that VERS is a voluntary scheme that will be offered to selected precincts, with flats about 70 years old. Up until today we haven't seen VERS being executed yet, but don't get your hopes up.

In the end, prevention is better than cure. Rather than putting your hopes on en bloc, SERS, or VERS, you should study the market before buying and plan an exit strategy early in the game. Remember, selling at the right time is just as important as buying at the right price. So here are some tips to help you maximise your investment before depreciation takes a toll.

Track market trends

Do your research before buying. Find the best locations, properties with unique appeals, developments with limited supply. These are going to be more resilient to lease decay. You also want to stay updated on property market performance in your area. If there are any ongoing transformations like new MRT lines or upcoming developments, it may temporarily boost demand even for ageing properties. This would be your golden opportunity to sell.

Monitor the lease timeline

If you're planning to keep your property in the long term, do monitor your lease. As we've covered, property value starts declining as they approach the 40-year mark, so you probably want to exit around this time when you can still find buyers.

Appeal to the right buyers

Yes, lease decay reduces buyer pools, but it doesn't completely eliminate them. Target buyers like families who may value affordability over tenure or expats looking for temporary stays.

Lease decay sucks, and there's not really a good solution once it's too late. You might not want to hear this, but the best thing you can do is to be proactive. Plan your exit strategy early and make informed decisions about your property. So if you want to maximise value before significant depreciation sets in, you should probably sell while the lease still has significant years remaining.

So how do you decide it's time to say goodbye to your leasehold? Take the time to evaluate whether holding onto your property is still worthwhile. Is your property ageing like fine wine or milk? Assess its current value against the potential costs of keeping it, such as reduced rental income, increasing maintenance expenses, and tighter financing options. If maintaining the property no longer makes financial sense, it's a sign to let go. Sure, moving is a hassle, and buying property feels overwhelming. But ignoring lease decay will just cost you way more in the long run.

If you want to explore more exit strategies or alternative options like leveraging their property's equity or restructuring ownership, our upcoming seminar is a great opportunity. Learn from industry leaders, including our CEO and Deputy CEO, who will share their expert insights to help you navigate the market and make the most of your investments.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.

Also read: To Hold Or Not To Hold? Will Holding Make Me More $$????? , Strategic Departures: Unveiling the Art of Exit Strategies , Breaking the New Launch Conflict: Leasehold or Freehold?