PropNex Picks

|January 16,2025Cooling Measures: The Good, The Bad, and The Impact

Share this article:

Cooling measures have long been a HOT topic (see what I did there?) in the real estate industry. Some people may hate them, complaining that they have to pay more ABSD after the government increased rates back in April 2023, or that they aren't able to invest in a second or third property anymore. However, others may appreciate the role that cooling measures play in the bigger picture.

So the question is: do these measures really help the market or are they just a hindrance for buyers?

Let's jump right in and explore the good, the bad, and the impact of cooling measures.

Cooling measures aren't new to Singapore. In fact, at least 15 rounds of cooling measures have been put in place since 2009 in attempts to regulate the market, especially to tame residential properties prices. At first, the government scrapped the Interest Absorption Scheme and the Interest-Only Scheme, which allowed people to pay less upfront. Then, in 2010, the government introduced the Seller's Stamp Duty (SSD) to prevent people from flipping homes quickly for profit. The following year, they introduced the Additional Buyer's Stamp Duty (ABSD) to limit speculation. Over time, these measures were fine-tuned to keep the market from overheating?.

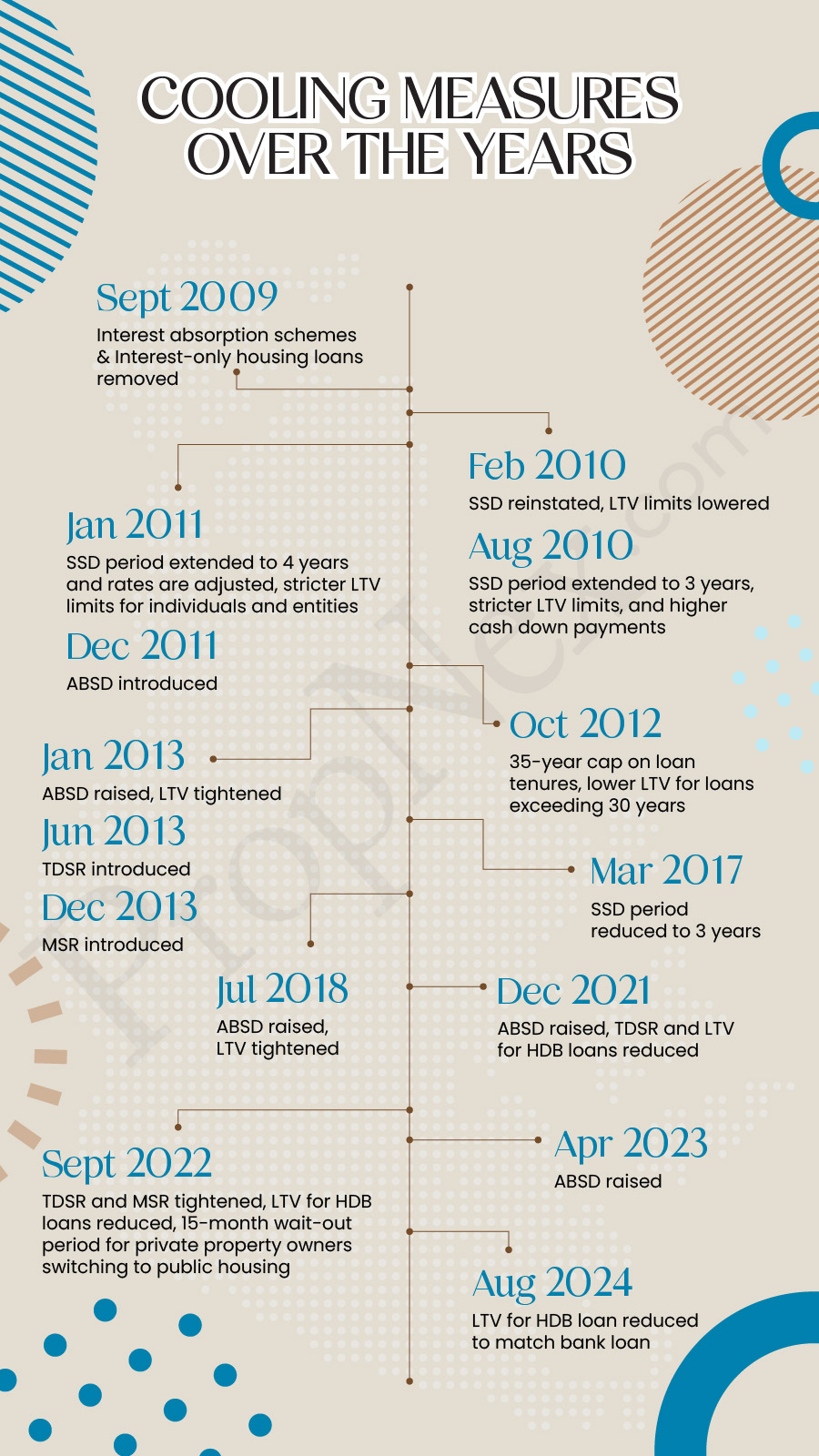

Cooling measures like strict Loan-to-Value (LTV) limits and ABSD rates raise the upfront costs of buying properties. In April of last year, ABSD rates experienced a steep hike. And as you can imagine, many people are unhappy about the new regulation. Foreign investors, who must pay one of the highest ABSD rates globally, are among the most affected. So it's no surprise that transactions by foreign buyers, especially in the Core Central Region (CCR) and luxury segment, plummeted drastically. In Q2 2023, only 108 non-landed private property deals involved foreigners, a 59.2% drop from the 265 transactions seen in the previous quarter.

As a consequence, developers face reduced sales volume, particularly in the luxury segment. This puts them into a tight spot, especially since they have to pay more in taxes if unsold units aren't cleared fast enough. This pressure may lead to fewer new launches or discounted prices that cut into profits, further slowing the market.

One of the effects of ABSD is to prevent developers from land-banking frivolously.

Singaporeans are not free from the burden of ABSD either, at least not if you are buying your second or subsequent property. Both Singapore Citizens (SC) and Singapore Permanent Residents (SPR) face higher ABSD rates, making it more difficult to expand their portfolio. For many, these increased costs feel like a roadblock, especially when combined with stricter financing options. Just last August, the government tightened the LTV ratio from 80% to 75%, which means buyers have to pay higher down payments!

Even selling your property can give you a migraine. Since the Seller's Stamp Duty (SSD) was introduced, you can't let go of your home too soon or you'll have to pay for it, literally. This can be frustrating if you need to move or invest in a different property. After all, in this industry, timing is everything.

The ripple effects don't stop there. Cooling measures can slow down not just real estate transactions but also industries connected to it: interior design, furniture shops, construction firms, even banks and conveyancing lawyers too. Like it or not, these measures can have unintended side effects.

Even if you don't want to believe it, cooling measures are not public enemy #1. They are in fact the unsung heroes of the industry. Let me illustrate. Think of the property market as a high-speed train. Cooling measures are the brakes on that train. They ensure the train stays on track and prevent it from getting out of control and crashing.

Before 2009, before Singapore introduced any cooling measures, speculation in the property market was running wild. Investors rushed to buy homes, expecting property values to continue rising. This speculative frenzy created a housing bubble, where prices became detached from the actual value of properties. When the bubble inevitably popped, housing prices crashed, and everyone who bet on them lost big time.

Early cooling measures were designed to eliminate these speculative activities.They discourage risky behaviour such as people buying homes they can't afford so they can flip them for a quick buck. By keeping prices grounded and balancing demand, the market stays resilient even in uncertain times. Cooling measures have come a long way since then, and we can see that the government continues to make sure that the market remains stable and sustainable.

Ultimately, these measures create a more cautious environment where consumers are less willing to overpay, keeping developers in check. When property prices start to get too high, buyers begin to hesitate, and developers could end up stuck with unsold units. So, they would rather price their properties more reasonably than lose out.

But perhaps one of the biggest perks of cooling measures is how they make homeownership more stable and accessible to Singaporeans. For example, the new LTV ratio introduced a few months ago (from 80% to 75%) does appear burdensome. However, this measure was counterbalanced by increasing subsidies, namely the Enhanced Housing Grant (EHG). For lower- to middle-income households, these grants might just be the reason they can afford their first home. This targeted financial support ensures that homeownership remains attainable for them despite the rising property prices?.

Cooling measures have both their upsides and downsides, but in the end, their impact is clear.

For buyers, these measures help curb the risk of overpaying and make homeownership more accessible for lower- and middle-income families. However, they also raise upfront costs for upgraders and seasoned investors, especially foreigners. As a result, developers face slower sales and higher financial pressure, which could ultimately reduce new housing supply and drive up long-term prices.

However, if you look at the big picture, cooling measures help prevent housing bubbles and maintain economic stability by curbing speculation. So, thanks to these robust measures, Singapore's property market has become one of the most resilient in the world. This is evident during crises like the pandemic, where our market went by unscathed. And, it is still growing steadily today. More importantly, they ensure that housing remains within the reach of the average Singaporean.

So, even though cooling measures pose certain challenges to certain groups, they're the reason Singapore's property market doesn't veer off into chaos. They help keep things fair, stable, and sustainable in the long run.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.

Also read: Stamp Duty Explained , Reducing Expenditures with Housing Schemes and Grants